All

Investment

Shopping

Leasing

Lodging

Residential

With a solid business ecosystem, we deliver long-term sustainable value to our stakeholders.

All

Investment

Shopping

Leasing

Lodging

Residential

With a solid business ecosystem, we deliver long-term sustainable value to our stakeholders.

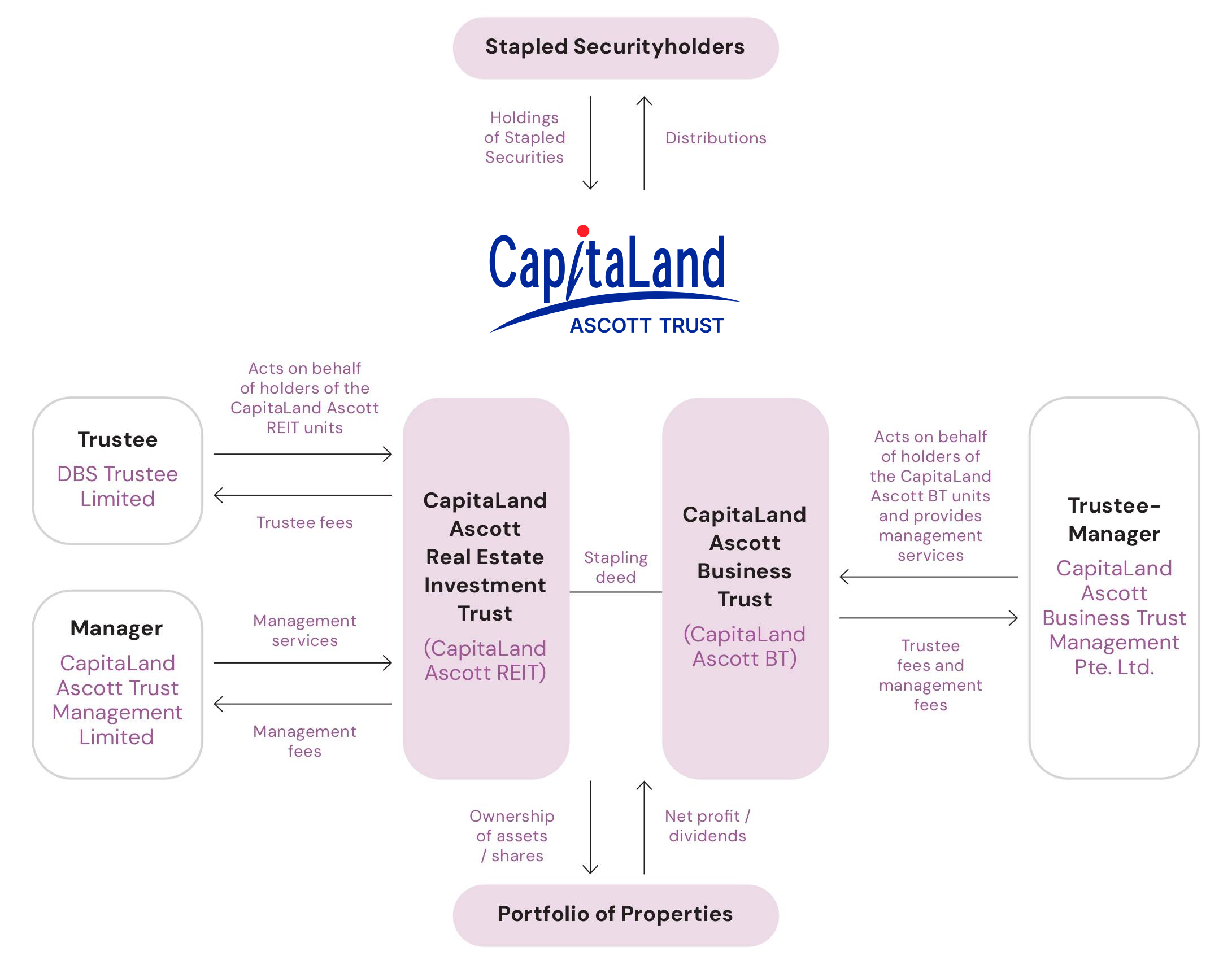

CLAS is a stapled group comprising CapitaLand Ascott Real Estate Investment Trust (CapitaLand Ascott REIT) and CapitaLand Ascott Business Trust (CapitaLand Ascott BT).

CLAS' investment mandate is to invest in real estate and real estate-related assets which are income-producing and which are used, or predominantly used, as serviced residences, rental housing properties, student accommodation and other hospitality assets in any country in the world.

The manager and trustee-manager of CLAS are wholly-owned subsidiaries of Singapore-listed CapitaLand Investment Limited, a leading global real asset manager with a strong Asia foothold.

| Entity Name | CapitaLand Ascott Trust |

| Trading Name | CapLand Ascott T |

| Stock Code | HMN |

| ISIN Code | SGXC16332337 |

| Bloomberg Ticker | CLAS:SP |

| Refinitiv Ticker | ASCO.SI |

CLAS shares are denominated in Singapore Dollars.

You may invest in CLAS shares through CDP and stock brokerage accounts as well as SRS.

|

Singapore Central Depository (Pte) Ltd. (CDP) |

For details on how to open a CDP securities account, please visit the CDP Intranet. Contact details of CDP:

Tel. +65 6535 7511 |

|

Supplementary Retirement Scheme (SRS) |

SRS accounts are managed by three bank operators:

You may approach the banks listed above to open an SRS account. |

As Stapled Securities are not eligible under the CPF Investment Scheme, you cannot use CPF funds to invest in CLAS after 31 December 2019 (the Ascott REIT Scheme Implementation Date pursuant to the combination of Ascott Residence Trust with Ascendas Hospitality Trust).

Those who have acquired shares in Ascott Residence Trust using CPF funds prior to 31 December 2019 may choose to hold or sell their shares.

For CDP holders, kindly update your mailing address via CDP's website.

For CPF/SRS holders, kindly update your mailing address with the respective banks.

You may contact our Share Registrar, Boardroom Corporate & Advisory Services Pte. Ltd., at clas@boardroomlimited.com or +65 6536 5355.

For CDP holders, kindly check your CDP account.

For CPF/SRS holders, kindly check with the respective banks.

CLAS' financial results and annual reports can be found under the Investor Relations section of this website.

CLAS' distribution history can be found here.

CLAS makes distributions on a semi-annual basis, for the six-month period ending 30 June and 31 December each year.

Distributions are paid out within 60 days after the close of every half year/six months.

For CDP holders, the distributions will go to the bank account that is linked to CDP.

For CPF holders, the distributions will go into your CPF account.

For SRS holders, the distributions will go into the bank account linked to your SRS account.

Individuals who hold Stapled Securities as investment assets and not through a partnership will receive tax-free distributions.

Scripholders are investors who hold their stapled securities or units in physical certificate form, instead of through a Central Depository ("CDP") account.

In Singapore, all share transactions are settled electronically on a scripless basis. Physical certificates (scrip-based units) are immobilized with CDP, and transfers are processed electronically.

This means physical certificates cannot be used for settlement. They must first be registered and deposited into your CDP account before you can trade.

Holding your securities in a CDP account allows you to:

From 1 January 2026, Singapore will be moving away from physical cheques to electronic payments only. As such, distribution payments will no longer be made via physical cheques. To receive distributions, you will need to deposit your units into a CDP account, and the distributions will be made directly into your designated bank account.

In addition, depositing your units into CDP enables you to trade the units, as physical certificates cannot be used for settlement.

Yes. You must have an active CDP account before you can deposit your units.

Singaporeans/PR can open a CDP account online via CDP's official website or the SGX mobile app. Please ensure that your CDP account is linked to your preferred bank account for electronic crediting of distributions.

CDP does not charge any account-opening or maintenance fees.

Please contact Boardroom for more information.

Boardroom Corporate & Advisory Services Pte. Ltd.

Call: +65 6536 5355

Email: enquiry@boardroomlimited.com

You can log in to CDP's online portal at investors.sgx.com/login using your Singpass to view and monitor your holdings.

Please contact Boardroom for more information.

Boardroom Corporate & Advisory Services Pte. Ltd.

Call: +65 6536 5355

Email: enquiry@boardroomlimited.com

For questions regarding your holdings or submission status, please contact:

Boardroom Corporate & Advisory Services Pte. Ltd.

Call: +65 6536 5355

Email: enquiry@boardroomlimited.com

For queries about your CDP account, please contact:

The Central Depository (Pte) Limited (CDP)

Call: +65 6535 7511