121

Overview

Sustainability

Business

Review

Portfolio

Details

Corporate

Governance &

Transparency

Financials &

Additional

Information

Ascott Residence Trust

Annual Report 2015

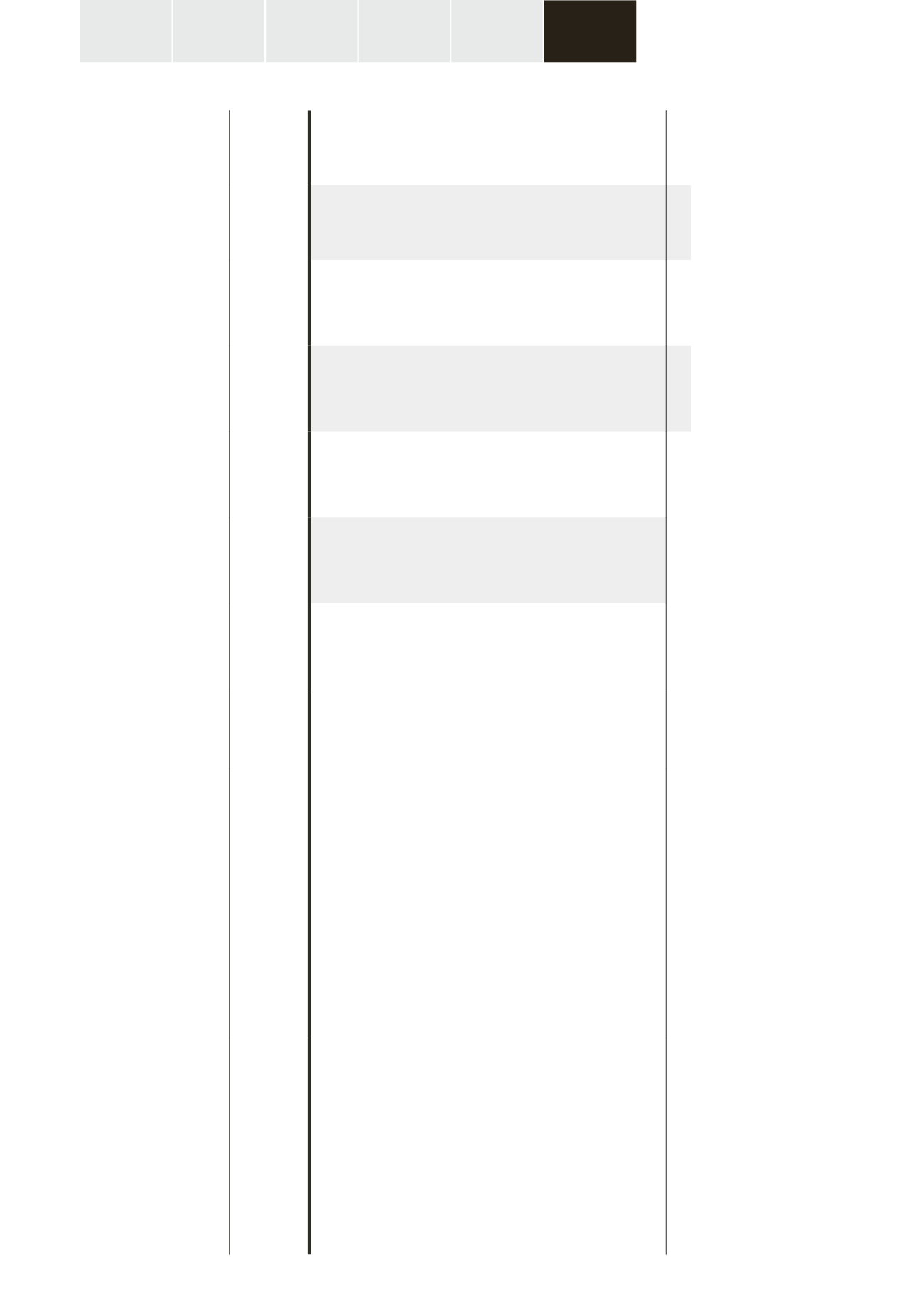

Portfolio Statements

As at 31 December 2015

By Geography

(continued)

Group

(continued)

Description of Property

Location

Tenure of

Land

Term of

Lease

Remaining

Term of Lease

At Valuation

Percentage of

Unitholders’ funds

2015

2014

2015

$’000

2014

$’000

2015

%

2014

%

Balance brought forward

2,027,726 1,814,509

92.6 86.1

Japan

(continued)

Grand E’terna Saga

(3)

1167-3, Ipponmatsu, Honjo,

Honjomachi, Saga

Freehold

Not

applicable

–

Not

applicable

–

9,726

–

0.5

Grand E’terna Saga Idaidori

(3)

4-3-4, Nabeshima,

Saga

Freehold

Not

applicable

–

Not

applicable

–

3,411

–

0.2

Gravis E’terna Nijojomae

(3)

469-2, Taruyacho, Nakagyo-ku,

Kyoto

Freehold

Not

applicable

–

Not

applicable

–

7,474

–

0.3

Grand E’terna Chioninmae

(3)

577-3, Inaricho, Minamigumi,

Higashiyama-ku,

Kyoto

Freehold

Not

applicable

–

Not

applicable

–

4,880

–

0.2

Infini Garden

(5)

3-2-2,3,4,5 KashiiTeriha,

Higashi-ku, Fukuoka

Freehold

Not

applicable

Not

applicable

Not

applicable

75,502 72,195

3.5

3.4

Citadines Central Shinjuku

(formerly known as

Best Western Shinjuku

Astina Hotel)

(8)

1-2-9, Kabuki-cho, Shinjuku-ku,

Tokyo

Freehold

Not

applicable

Not

applicable

Not

applicable

111,326 91,353

5.1

4.3

Balance carried forward

2,214,554 2,003,548 101.2 95.0

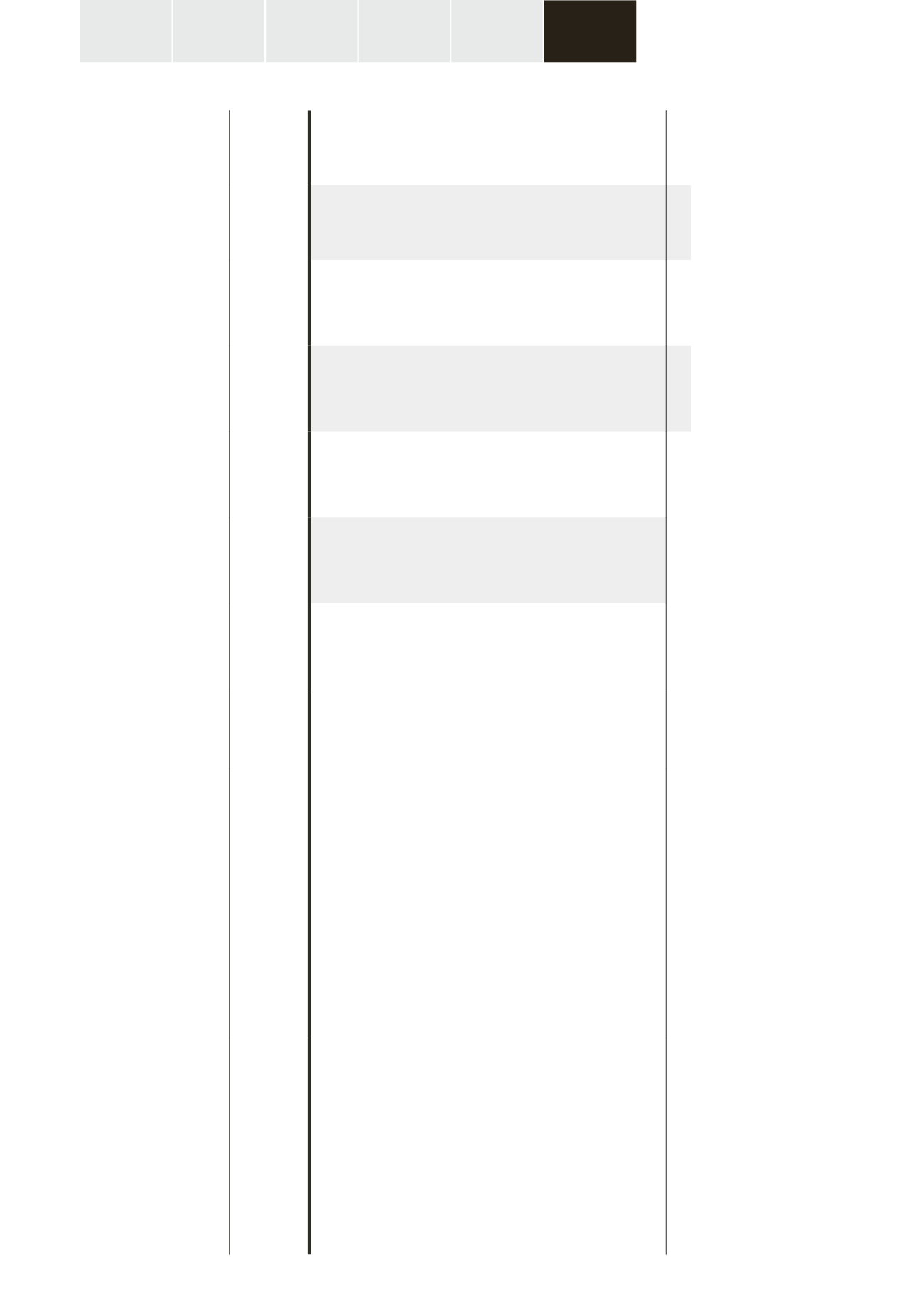

(3)

On 30 September 2015, the Group completed the sale of the trust beneficiary interest of six rental housing properties to Samty Co., Ltd, an unrelated third party. The valuations were based on the direct

capitalisation method.

(5)

On 20 March 2014, the Group completed the acquisition of a rental housing property in Japan from a related corporation and an unrelated third party. The valuation was based on the discounted cash flow

approach.

(8)

On 16 October 2014, the Group acquired Citadines Central Shinjuku (formerly known as Best Western Shinjuku Astina Hotel) from an unrelated third party, Kabushiki Kaisha Oumi. The valuation was based

on the discounted cash flow approach.

The accompanying notes form an integral part of these financial statements.