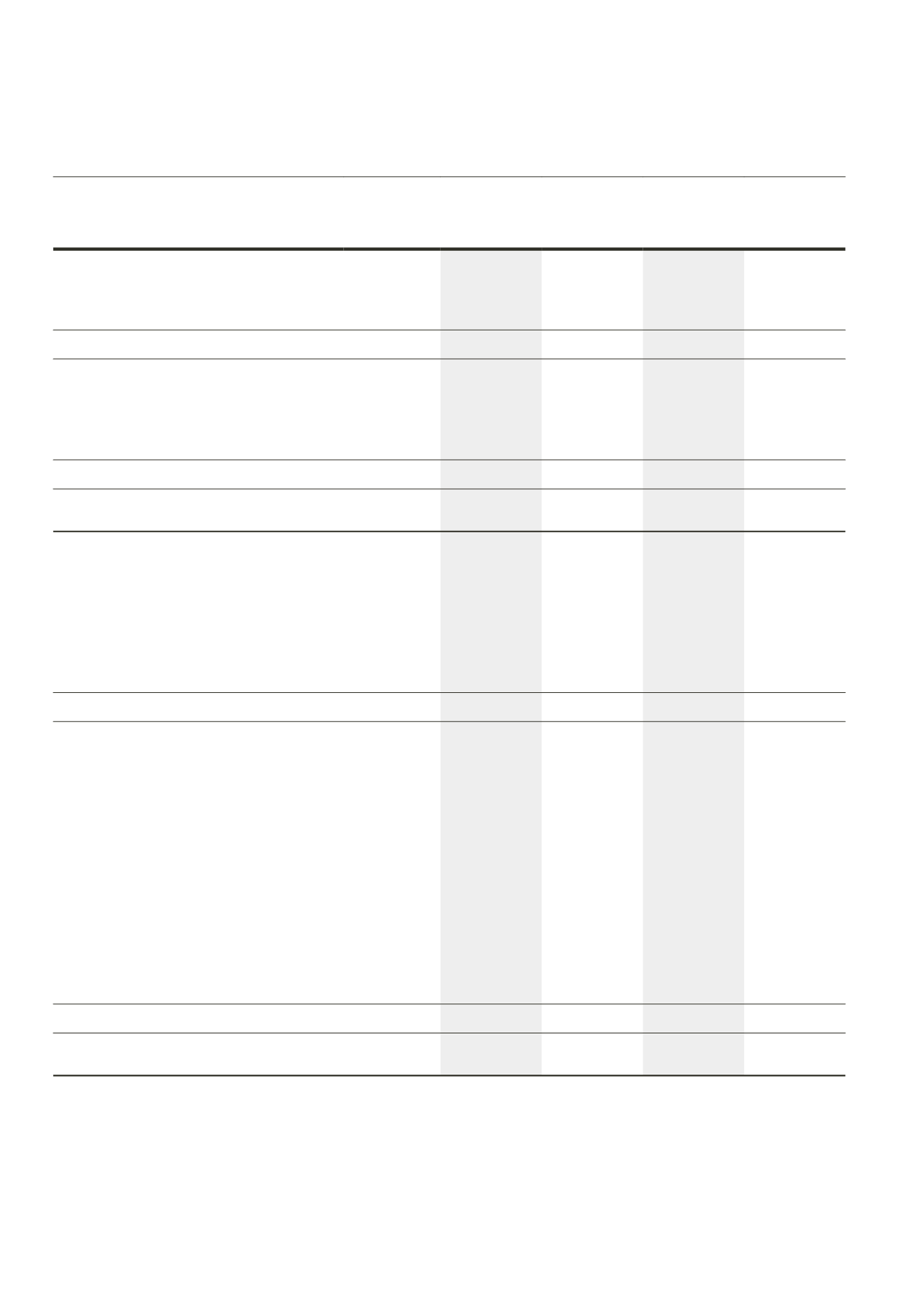

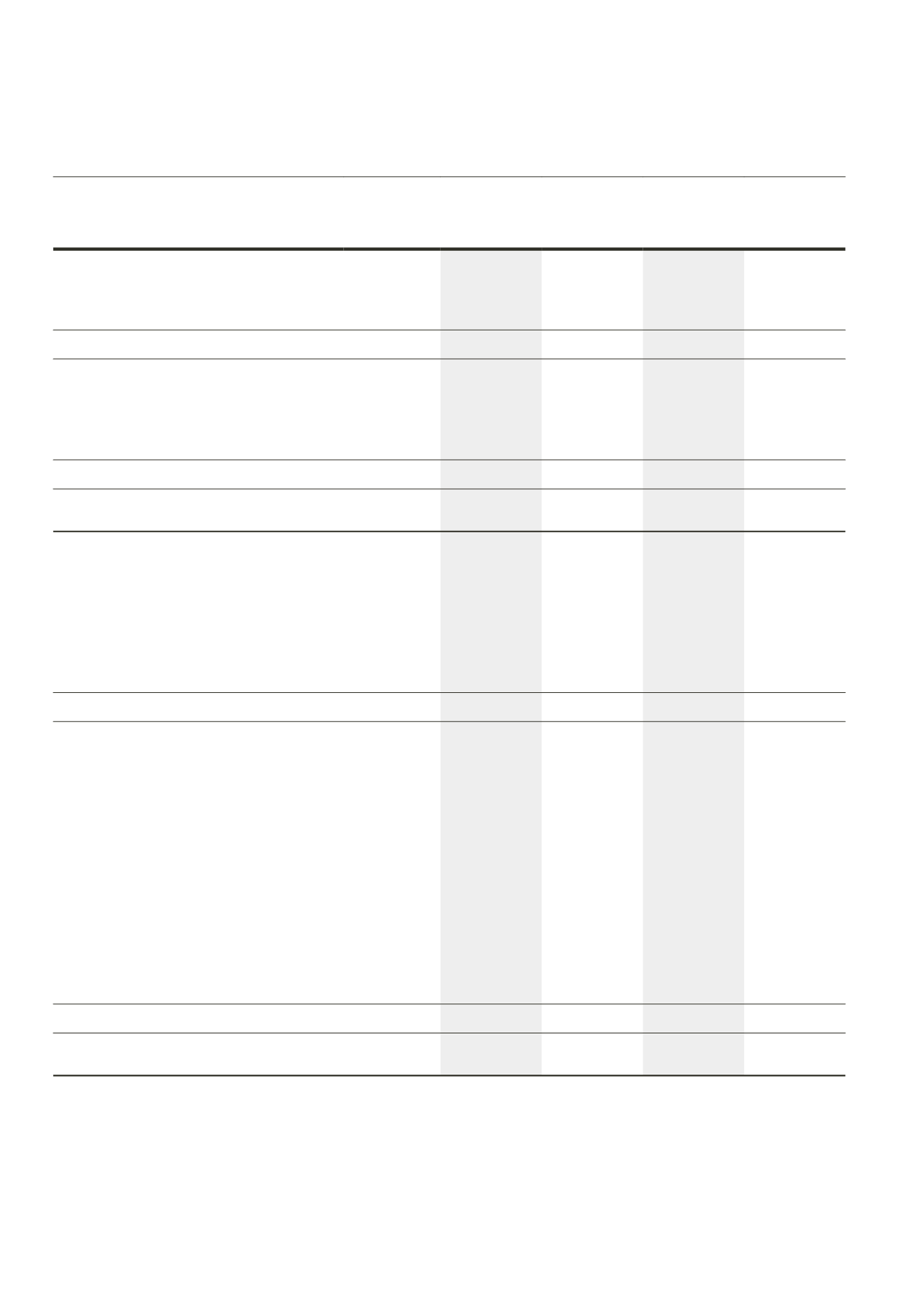

114

Ascott Residence Trust

Annual Report 2015

Group

Trust

Note

2015

$’000

2014

$’000

2015

$’000

2014

$’000

Capital reserve

At 1 January

2,008

1,818

–

–

Transfer from operations

–

190

–

–

At 31 December

2,008

2,008

–

–

Hedging reserve

At 1 January

(15,117)

(10,769)

(11,582)

(9,608)

Effective portion of change in fair values

of cash flow hedges

5,377

(4,348)

5,150

(1,974)

At 31 December

(9,740)

(15,117)

(6,432)

(11,582)

Unitholders’ funds at 31 December

2,189,714 2,106,078 1,614,527 1,679,153

Perpetual securities

At 1 January

149,351

–

149,351

–

Issue of perpetual securities

250,000 150,000 250,000 150,000

Issue expenses

28

(2,321)

(2,005)

(2,321)

(2,005)

Total return attributable to

perpetual securities holders

13,430

1,356

13,430

1,356

Distribution to perpetual securities holders

(13,366)

–

(13,366)

–

At 31 December

397,094 149,351 397,094 149,351

Non-controlling interests

At 1 January

97,807

94,050

–

–

Total return attributable to

non-controlling interests

13,807

7,904

–

–

Distribution to non-controlling interests

(3,382)

(3,228)

–

–

Change in ownership interests in subsidiaries

with no change in control

(30,330)

154

–

–

Effective portion of change in fair values of

cash flow hedges

166

(156)

–

–

Exchange differences arising from translation

of foreign operations and foreign currency

loans forming part of net investment

in foreign operations

3,700

(917)

–

–

At 31 December

81,768

97,807

–

–

2,668,576 2,353,236 2,011,621 1,828,504

Statements of Movements in Unitholders’ Funds

Year ended 31 December 2015

The accompanying notes form an integral part of these financial statements.