113

Overview

Sustainability

Business

Review

Portfolio

Details

Corporate

Governance &

Transparency

Financials &

Additional

Information

Ascott Residence Trust

Annual Report 2015

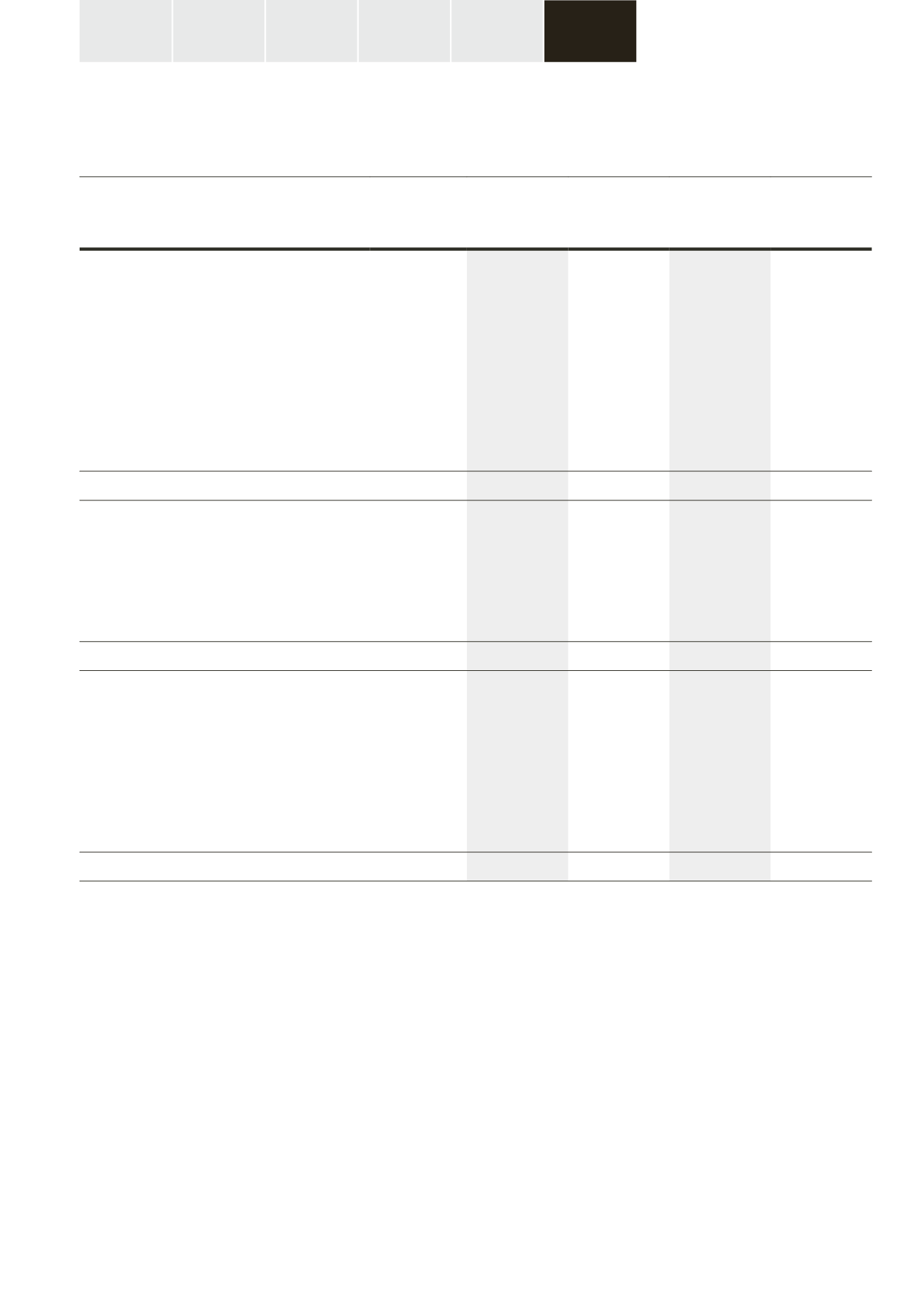

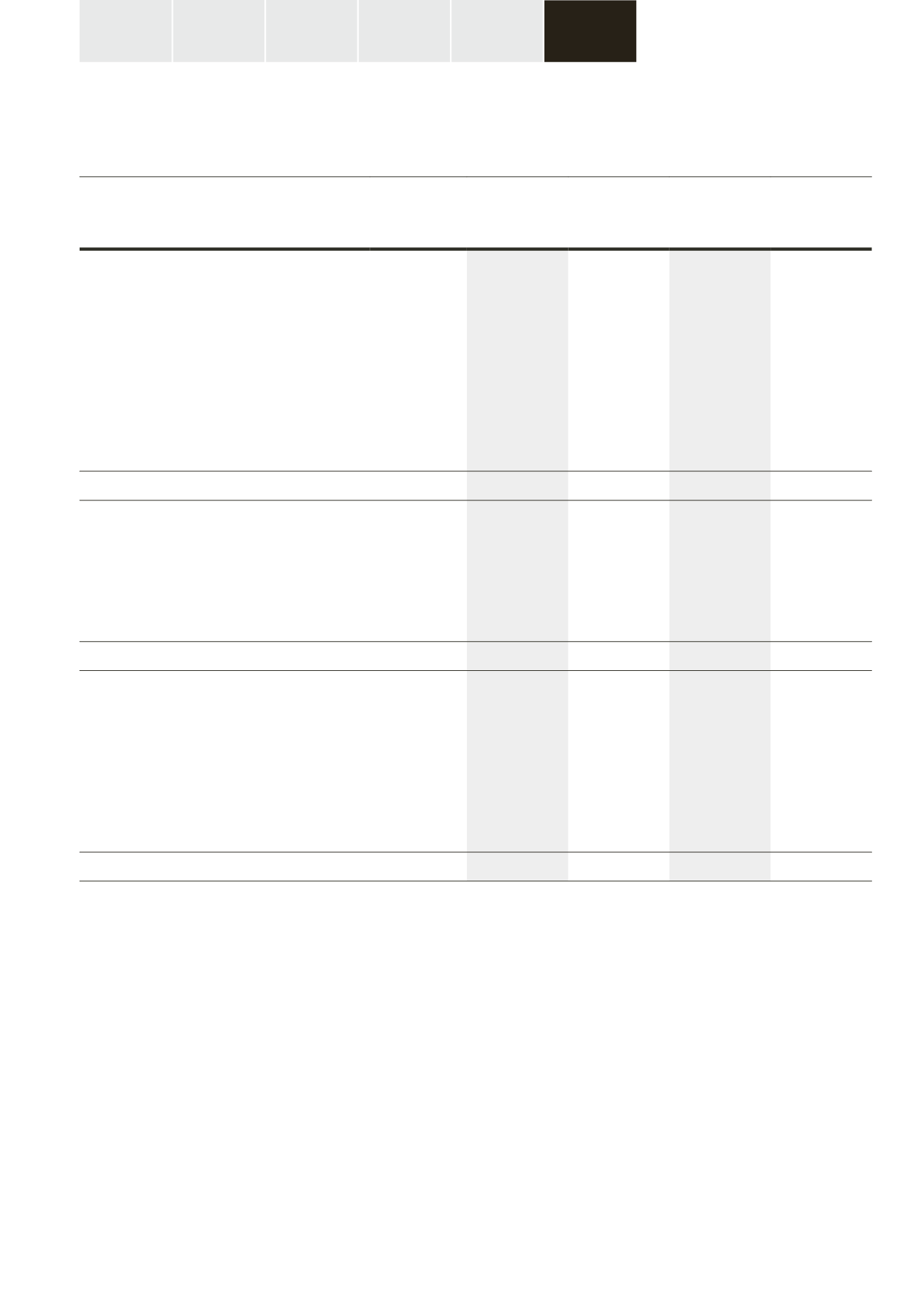

Statements of Movements in Unitholders’ Funds

Year ended 31 December 2015

Group

Trust

2015

$’000

2014

$’000

2015

$’000

2014

$’000

Operations

At 1 January

707,167 615,777 214,631 212,960

Total return attributable to

Unitholders/perpetual securities holders

165,183 122,468

51,197

32,405

Total return attributable to

perpetual securities holders

(13,430)

(1,356)

(13,430)

(1,356)

Distributions to Unitholders

(59,891)

(29,378)

(59,891)

(29,378)

Change in ownership interests in subsidiaries

with no change in control

6,225

(154)

–

–

Transfer to capital reserve

–

(190)

–

–

At 31 December

805,254 707,167 192,507 214,631

Unitholders’ contributions

At 1 January

1,476,104 1,547,895 1,476,104 1,547,895

Creation of Units:

- Manager’s fees paid in Units

14,265

12,821

14,265

12,821

- Acquisition fees paid in Units

2,903

2,478

2,903

2,478

Distributions to Unitholders

(64,820)

(87,090)

(64,820)

(87,090)

At 31 December

1,428,452 1,476,104 1,428,452 1,476,104

Foreign currency translation reserve

At 1 January

(64,084)

(61,641)

–

–

Change in ownership interests in subsidiaries

with no change in control

(7,215)

–

–

–

Exchange differences arising from translation

of foreign operations and foreign currency

loans forming part of net investment in

foreign operations

35,039

(2,443)

–

–

At 31 December

(36,260)

(64,084)

–

–

The accompanying notes form an integral part of these financial statements.