214

Ascott Residence Trust

Annual Report 2015

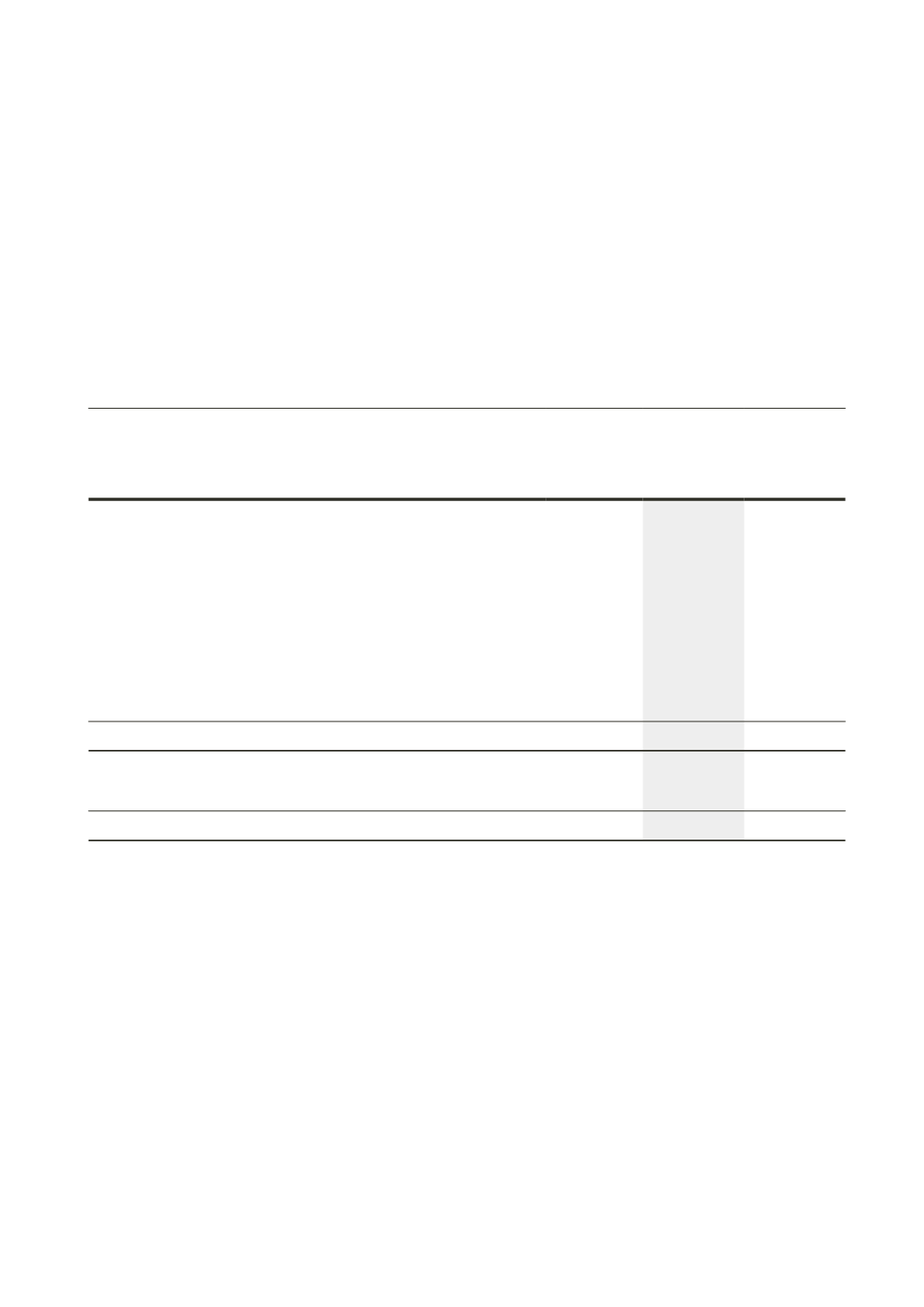

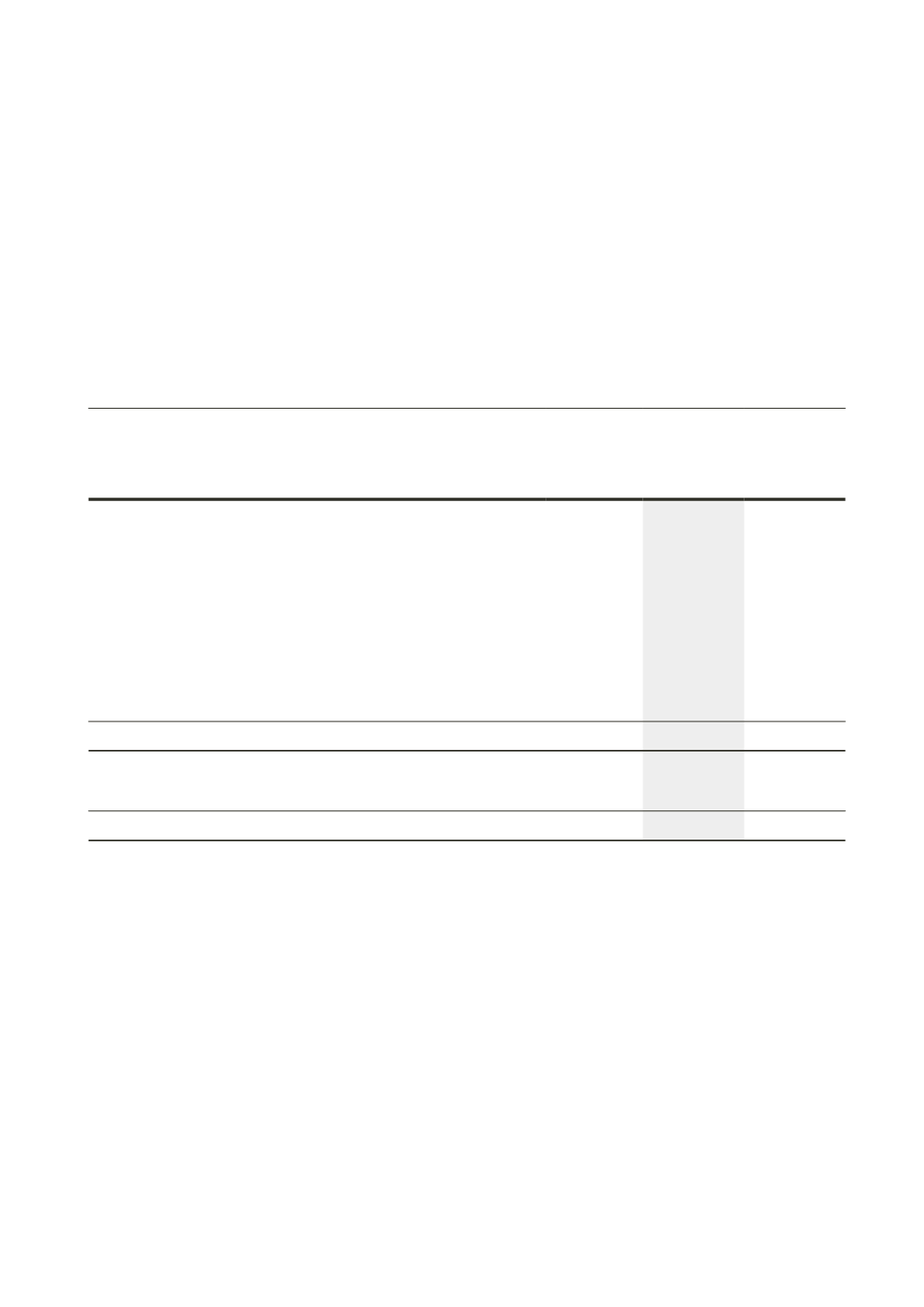

34 Acquisition of serviced residence properties and non-controlling interests, net of cash movements

(continued)

Acquisition of serviced residence properties and subsidiaries

(continued)

From the respective acquisition dates to 31 December 2014, the serviced residence properties and subsidiaries

contributed loss after tax of $1,808,000, mainly arising from a loss on revaluation of these serviced residence

properties. If the acquisitions had occurred on 1 January 2014, the Manager estimates that the consolidated

revenue would have been $390,732,000 and consolidated return for the year would have been $134,019,000.

The cash flows and net assets and liabilities of serviced residence properties and subsidiaries acquired are

provided below:

Recognised values

on acquisition

2015

$’000

2014

$’000

Serviced residence properties

461,618 546,441

Plant and equipment

2,802

8,798

Deferred tax assets

–

56

Inventories

14

46

Trade and other receivables

1,411

2,637

Cash and cash equivalents

15,352

19,779

Trade and other payables

(4,415)

(13,964)

Financial liabilities

(42,540)

(115,592)

Provision for taxation

(41)

(34)

Deferred tax liabilities

(14)

(31)

Net identifiable assets and liabilities acquired

434,187 448,136

Total consideration

434,187 448,136

Cash of subsidiaries acquired

(15,352)

(19,779)

Cash outflow on acquisition of serviced residence properties

418,835 428,357

Acquisitions of serviced residence properties and subsidiaries are complex in nature and can be material to

the financial statements. Assessment is required to determine the most appropriate accounting treatment of

assets acquired and of potential contractual arrangements relating to the acquisitions. The acquisitions during

the year were accounted for as acquisitions of serviced residence properties based on the assessments by

the Manager.

Notes to the Financial Statements

Year ended 31 December 2015