209

Overview

Sustainability

Business

Review

Portfolio

Details

Corporate

Governance &

Transparency

Financials &

Additional

Information

Ascott Residence Trust

Annual Report 2015

33 Fair value of assets and liabilities

(continued)

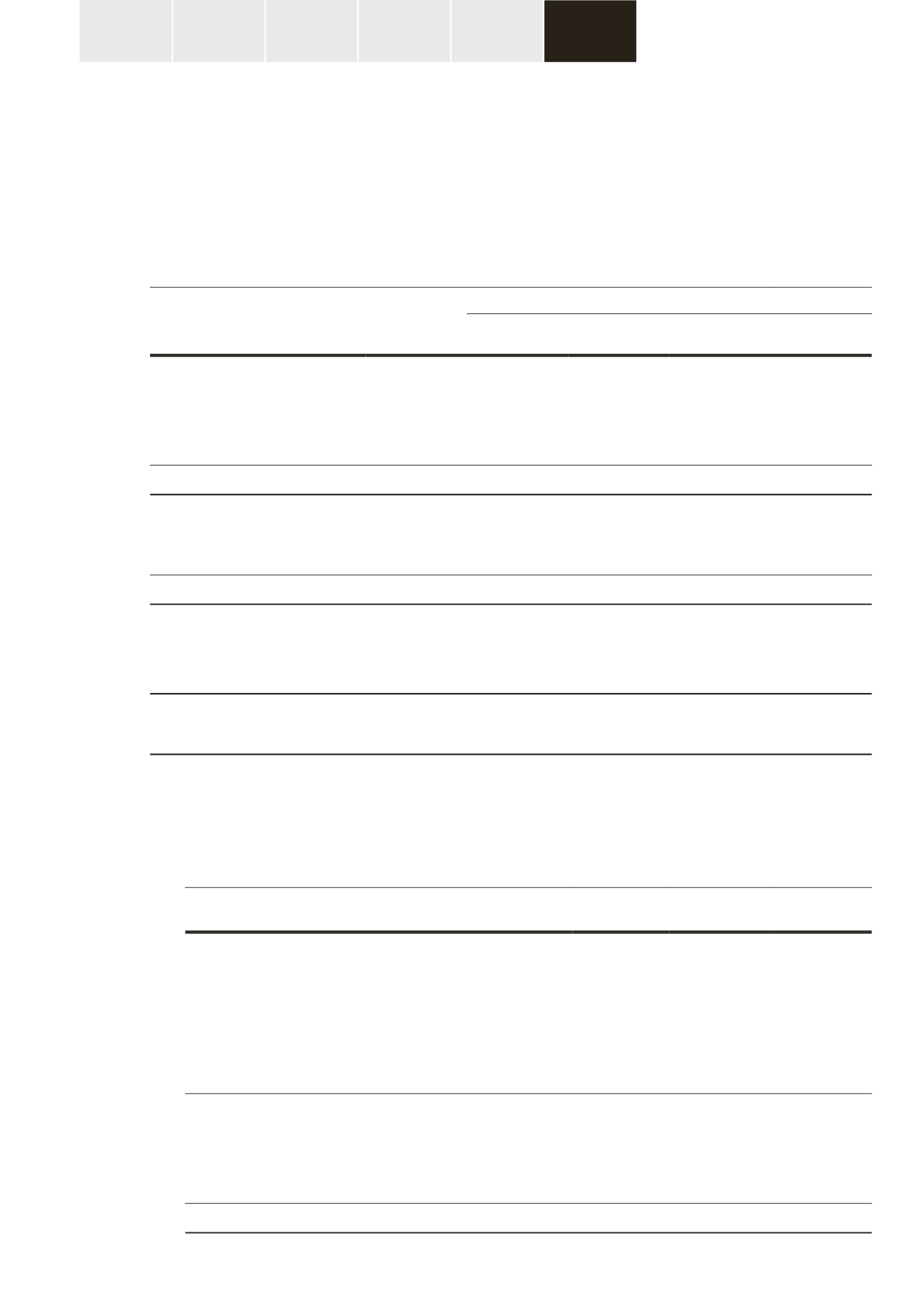

(b) Accounting classifications and fair values

(continued)

The following table shows the carrying amounts and fair values of significant non-financial assets,

including their values in the fair value hierarchy.

Fair value

Note

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

Group

31 December 2015

Serviced residence properties

4

–

– 4,289,711 4,289,711

Assets held for sale

13

–

–

84,207

84,207

–

– 4,373,918 4,373,918

31 December 2014

Serviced residence properties

4

–

– 3,724,036 3,724,036

Assets held for sale

13

–

–

87,403

87,403

–

– 3,811,439 3,811,439

Trust

31 December 2015

Serviced residence properties

4

–

–

563,091 563,091

31 December 2014

Serviced residence properties

4

–

–

558,693 558,693

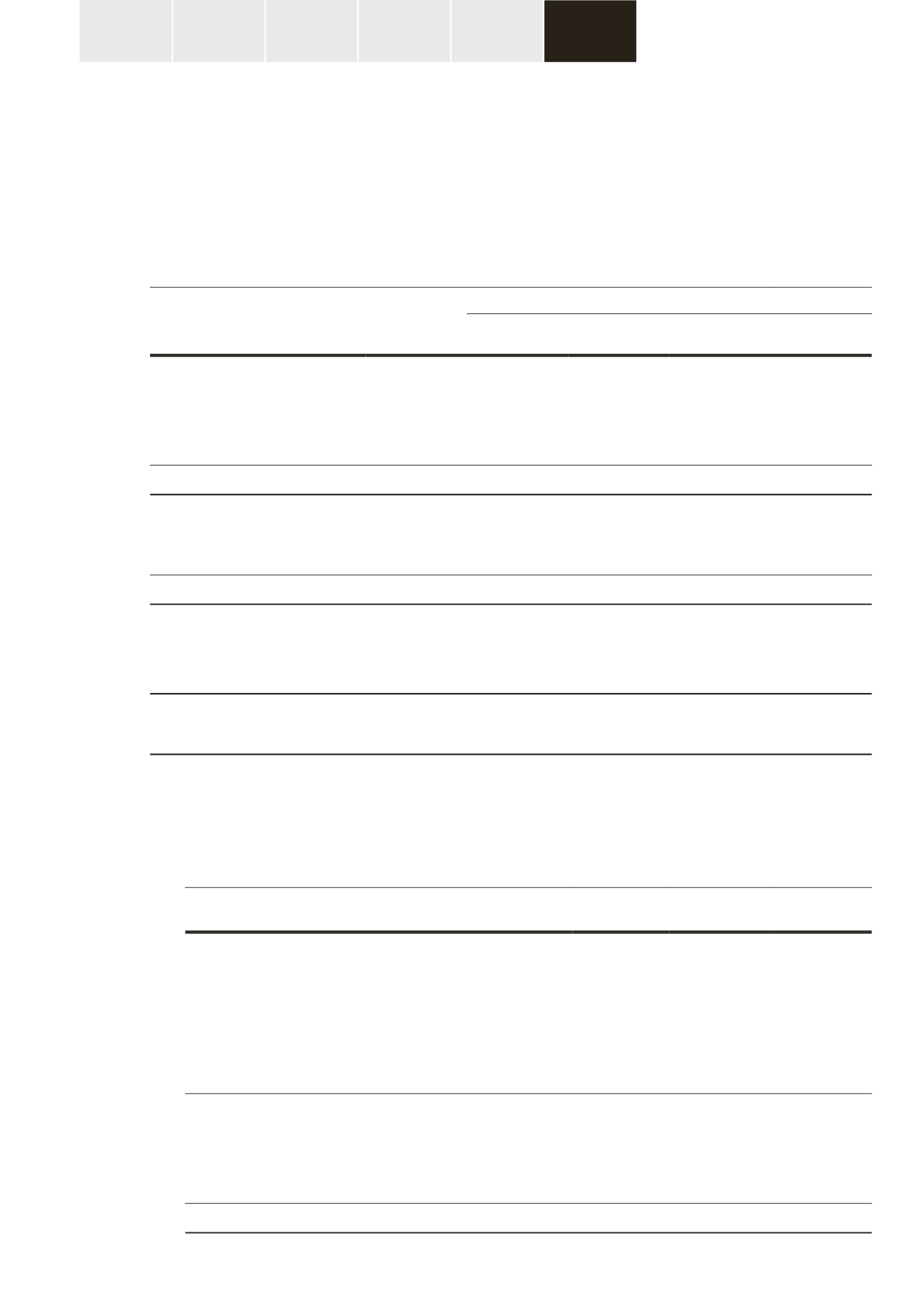

(c) Level 3 fair value measurements

(i) Reconciliation of Level 3 fair value

The following table presents the reconciliation from the beginning balances to the ending balances

for Level 3 fair values.

Group

$’000

Trust

$’000

Serviced residence properties

Balance at 1 January 2015

3,724,036 558,693

Acquisition of subsidiaries and serviced residence properties

461,618

–

Capital expenditure

38,138

157

Divestments of serviced residence properties

(48,175)

–

Transfer from plant and equipment

683

–

Translation difference

38,668

–

Balance at 31 December 2015

4,214,968 558,850

Gains and losses for the year

Net change in fair value recognised in statement of total return

78,460

4,241

Assets written off

(3,717)

–

Balance at 31 December 2015

4,289,711 563,091