25 NET DIVESTMENT EXPENSES

In 2013, net divestment expenses relate to the expenses incurred in connection with the

disposal of strata units in Somerset Grand Fortune Garden Property Beijing.

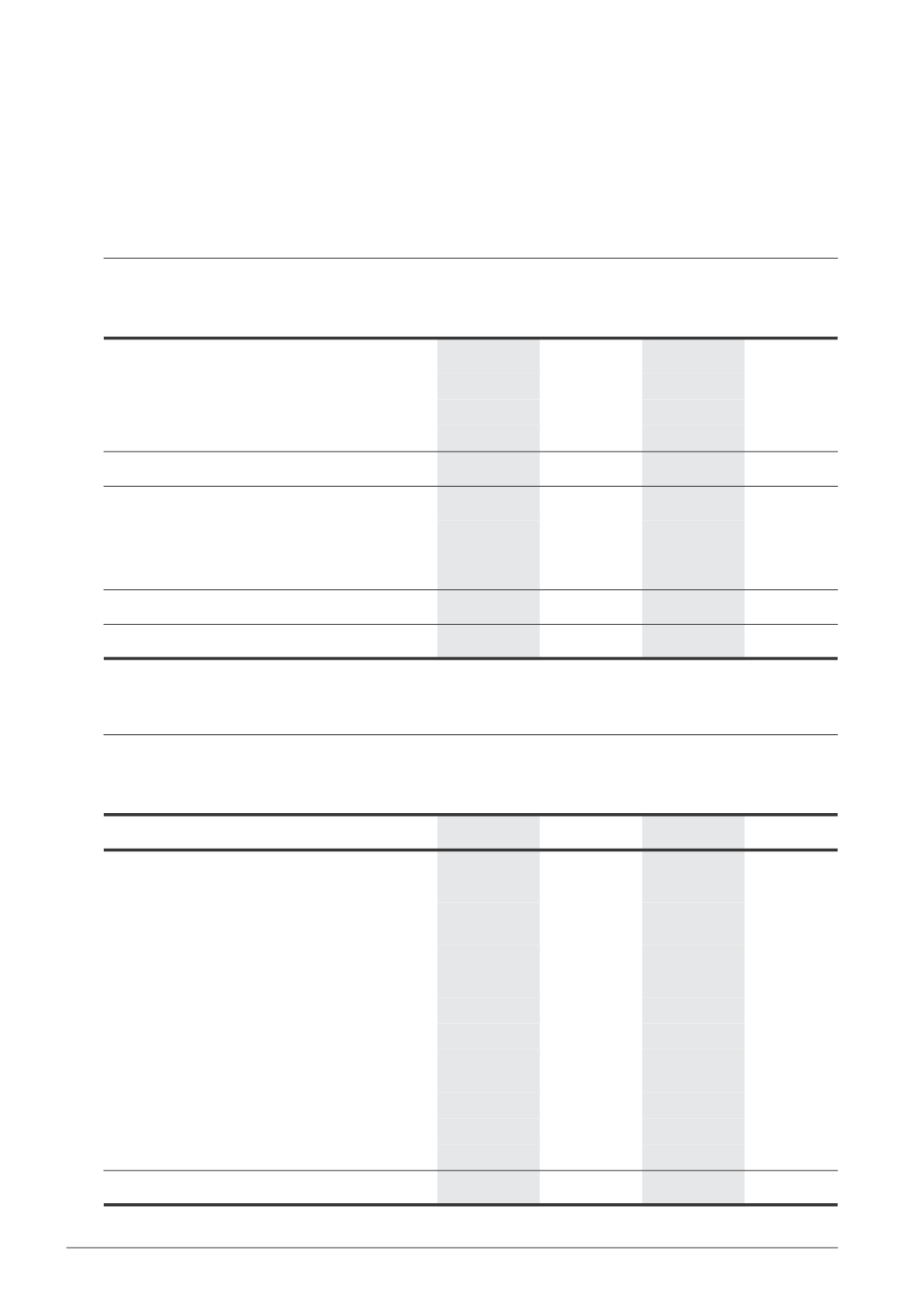

26 INCOME TAX EXPENSE

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Current tax expense

Current year

21,530

19,303

70

273

Under/(over) provided in prior years

716

(2,450)

11

(6)

Withholding tax

2,990

2,579

–

–

25,236

19,432

81

267

Deferred tax expense

Origination and reversal of temporary

differences

11,451

20,861

−

−

Under/(over) provided in prior years

256

(4,084)

−

−

11,707

16,777

−

−

Income tax expense

36,943

36,209

81

267

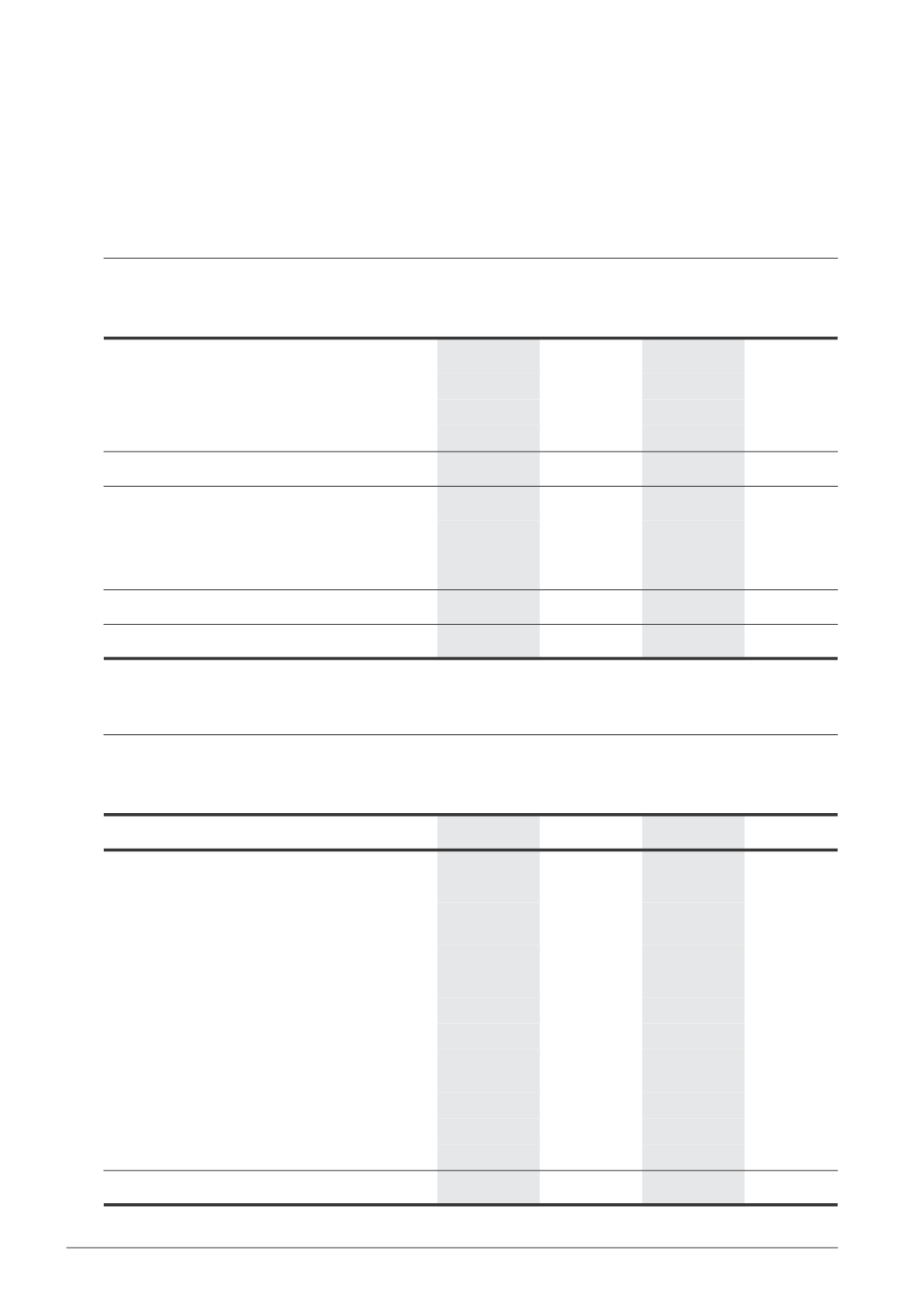

Reconciliation of effective tax rate

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Total return before income tax

167,315

251,563

32,486

43,221

Income tax using the Singapore tax rate of

17% (2013: 17%)

28,444

42,766

5,523

7,348

Effect of different tax rates in foreign

jurisdictions

19,302

21,641

–

–

Tax rebate/relief/exemption

(18)

(10)

(12,117)

(9,487)

Income not subject to tax

(32,001)

(43,608)

(500)

(3,255)

Tax benefits not recognised

1,434

2,346

–

–

Expenses not deductible for tax purposes

16,502

17,671

7,247

6,156

Utilisation of previously unrecognised

tax losses

(599)

(153)

–

–

Tax transparency

(83)

(489)

(83)

(489)

Under/(over) provision in prior years

972

(6,534)

11

(6)

Withholding tax

2,990

2,579

–

–

36,943

36,209

81

267

Notes to the Financial Statements

Year ended 31 December 2014

168 | Ascott Residence Trust Annual Report 2014